Independent local meat processors are a vital component of resilient food systems. They also contribute to the rural economy, provide a needed service to livestock producers, and ensure quality meat is readily available.

Because of their value, several resources exist for new and existing meat processors. This page contains information on federal, state, and local programs for independent meat processors, as well as information on the Center for Rural Affairs efforts to strengthen local processing, including the Nebraska Independent Processor Assistance Program.

Meat & Poultry Processing Loans

Meat & Poultry Processing Loans are established under the USDA Meat and Poultry Intermediary Lending Program guidelines. The purpose of the Center for Rural Affairs’ Meat & Poultry Processing Loan Fund is to strengthen and expand small and medium sized primary and secondary meat processing infrastructure.

Eligibility and limitations

Meat & Poultry Processing Loans are available to primary (slaughter) and secondary (cut, pack, value-added) meat processors. Processors must either be USDA inspected or plan to seek USDA inspection to be eligible.

Custom exempt facilities are eligible for our small business loans, available at cfra.org/small-business-loans.

Loans are available in the state of Nebraska. Loans may be available outside of Nebraska if adequate funds remain available.

Use of Funds

Meat & Poultry Processing Loans will support the following loan purposes:

- Expansion of existing business

- Start-up of new business

- Real estate purchase

- New construction

- Facilities update or expansion

- Equipment purchase

- Energy efficiency upgrades to facilities and equipment

- Purchase of an existing business

- Working capital

Rates and fees

Loans will have a rate that is equal to or less than what a particular project may qualify for elsewhere when considering loan risk, loan size, and related factors. As of May 2023, rates are anticipated to be between 4% and 7%.

In addition, Meat & Poultry Processing Loans may be charged a closing fee between 1% and 3% of the loan amount depending on loan size, loan complexity, and credit risk. There is no penalty for prepayment.

Terms

Amortization periods will be from 1 to 20 years based on the use of funds, with working capital or construction loans being available on terms from 1 to 3 years, equipment or facility upgrades on terms of 3 to 15 years, and construction or real estate on terms of 10 to 20 years. In general, terms will match the useful life of the business asset being financed. Longer term loans may utilize periodic balloon payments with option to refinance.

Loan limits and participations

Meat & Poultry Processing Loans may range from $50,000 to $5 million. Participation loans with other lenders are encouraged, and may be required for larger projects.

Owner equity

In general, we require that an owner has made in the past or will make a financial investment in their business equal to a minimum of 10% to 20% of the requested loan amount. For start ups, this will be a cash investment. For existing business, this may include past investments or accumulated operating equity.

Collateral requirements

Meat & Poultry Processing Loans are collateralized by business or personal assets. Applicants should be willing to provide collateral, but applicants who do not have adequate collateral to pledge will be considered. Strong collateral will not be sufficient to justify loan approval if repayment capacity cannot be established and documented.

Underwriting process

Loans will be underwritten based on historic and projected cash flows with demonstrated ability to repay being the primary underwriting consideration. All loans require concurrence from USDA on the underwriting recommendation.

Required documents

A partial list of required documents appears below. Each loan is unique, and additional documents may be required based on the circumstances of the loan.

- Business financials statements

- Year-to-date profit and loss statement

- Current business balance sheet

- Business tax returns

- Proof of business ownership

- Trade name registration, if applicable

- Schedule of sources and uses

- Proof of personal equity injection

- Business plan

- Business bank statements

- Personal financial statement

- Personal tax returns

- Environmental review, if required by USDA and by project

Interested borrowers can contact Meg Jackson at 402.309.9096 or [email protected]. Or start by completing our initial intake form at this link or visit our loan page.

State programs

Several states operate specific meat processing programs. Their general aim is to increase the capacity of small processing facilities, typically by incentivizing expansion or startup. Below are examples of state processor programs. To find a comprehensive list, visit this Niche Meat Processing page. Because programs start, end, and change regularly, be sure to search within your home state for up to date information.

Some states have only developed programs in the wake of supply disruptions caused by COVID-19. Many of these new programs are funded solely by federal relief and thus may be unusable in one or two years if appropriations are not made by their states.

- Expanding or renovating processing facilities: North Carolina’s program supports a wide range of potential uses, including facility expansion. Oklahoma’s program will provide up to $1 million toward facility expansion or renovation.

- Preparation for government certification: Iowa’s program, which is funded through COVID-19 relief money, will allow recipients to use the money for purchases in relation to a future government certification, such as USDA or state inspection.

- COVID-19 response: Montana has a small program focusing on expansion of processors in response to the pandemic. Indiana has a similar program. Both have broad uses and limit recipients to $150,000.

Nebraska Independent Processor Assistance Program

The Independent Processor Assistance Program (IPAP) is designed to improve and expand Nebraska’s meat-processing capabilities. Grants are available through the Nebraska Department of Agriculture (NDA) for newly operating meat processors to facilitate improvements or expansions that will increase harvest capacity or production.

The NDA will award the final round of IPAP grant funds in the approximate amount of $5.1 million. NDA will begin accepting grant applications on Jan. 16, 2024. The deadline to apply is Feb. 16, 2024.

Eligibility standards

- Must operate as either a U.S. Department of Agriculture - Food Safety and Inspection Service (USDA-FSIS) facility or a federally regulated custom-exempt slaughter and processing facility, while also complying with federal regulations.

- Must have existing annual sales revenue under $2.5 million.

- Must employ fewer than 25 employees.

- Must be in Nebraska and registered in good standing with the Secretary of State to do business.

Have questions or need assistance?

- Find documents offering guidance for meat processing plant grants here.

- Center for Rural Affairs staff is also available to assist. Please reach out to Meg Jackson, 02.309.9096 or [email protected] or Carlie Jonas, 402.687.2100 ext. 1032 or [email protected]

Read more about IPAP in this fact sheet.

Nebraska Herd Share Program

During its 2021 session, the Legislature recognized the need to make it easier for consumers to purchase individual packages of meat directly from producers or processors with the unanimous passage of LB 324. The legislation created a framework for what is known as a herd share program.

Read more about the program in our Nebraska Herd Share Resource Guide:

English | Spanish

Iowa Butchery Innovation and Revitalization Program

The Iowa Legislature passed House File (HF) 857 in 2021, creating the Butchery Innovation and Revitalization Program. This program provides assistance to new and existing small meat lockers in the form of grants, low-interest loans, and forgivable loans to help them increase capacity.

Eligible uses include expanding, refurbishing, or establishing a state-inspected, federally-inspected, licensed custom, or mobile slaughter facility and for the renting of buildings, refrigeration and freezer facilities, or other equipment necessary for expanding processing capacity. It is only available for meat processors that employ less than 50 employees. In the program’s first year, grants were awarded to 15 small businesses across the state. During its 2022 session, the Iowa Legislature approved $1 million for the fund.

Iowa Artisanal Butchery Task Force

HF 857 also created the Artisanal Butchery Task Force, made up of processors, culinary professionals, livestock producers, and others. During the 2022 session, Iowa lawmakers approved HF 2470, implements a number of recommendations by the task force, including creating the framework for a one-year community college certificate program on artisanal butchery.

In addition, HF 2470 requires the Department of Workforce Development and the Economic Development Authority to create and maintain a library of resources for Iowa-based meat processing businesses. The bill also asks the Department of Agriculture and Land Stewardship to create a direct-to-consumer toolkit.

USDA Meat and Poultry Inspection Readiness Grants

The Meat and Poultry Inspection Readiness Grant (MPIRG) program assists currently operational meat and poultry slaughter and processing facilities in obtaining a Federal Grant of Inspection under the Federal Meat Inspection Act (FMIA) or the Poultry Products Inspection Act (PPIA); or to operate as a state-inspected facility that is compliant with FMIA or PPIA under a respective Cooperative Interstate Shipment (CIS) program.

Commercial businesses, cooperatives, and Tribal enterprises are eligible to apply. The USDA encourages applications aimed at increasing access to slaughter or processing facilities for smaller farms and ranches, new and beginning farmers and ranchers, socially-disadvantaged producers, and veteran producers.

The MPIRG focuses on:

- Improving meat and poultry slaughter and processing capacity and efficiency;

- Developing new and expanding existing markets;

- Increasing capacity and better meeting consumer and producer demand;

- Maintaining strong inspection and food safety standards;

- Obtaining a larger commercial presence; and

- Increasing access to slaughter/processing facilities for smaller farms and ranches, new and beginning farmers and ranchers, socially disadvantaged producers, veteran producers, and/or underserved communities.

USDA’s Agricultural Marketing Service grants management specialists are available to answer questions during regular business hours. For more information about grant eligibility and program requirements, visit ams.usda.gov/services/grants/mpirg, or email [email protected].

USDA programs

USDA administers two programs that provide direct assistance to the production of food, including meat—the Local Food Promotion Program (LFPP) and Value-Added Producer Grants (VAPG). While there is not a program exclusively for the processing of meat, these programs are directed to local and regional food production, processing, and distribution, therefore, most small processors could utilize them, if desired.

Programs specifically designed for meat processing are currently under development at the state and federal level. As noted in the section below, state programs vary and funding changes on an annual basis. We will update this page as these programs are created and changed.

Value-Added Producer Grant

VAPG provides funding directly to agricultural producers for a diverse range of projects. Unlike other programs, partnerships are not required. Farmers and ranchers, groups of producers, cooperatives, and others can apply, so long as those individuals are producing the raw product themselves.

The aim of the program is to turn raw products into processed, usable goods to sell to customers. Two grant types are offered—planning and working capital. Planning grants can be used for market analysis, feasibility studies, analyzing the business’s structure, and anything else which precedes development of the product. Working capital grants can pay for the direct expenses related to processing a product for eventual market sale. This could mean equipment, building renovation, even some employee salary among other things.

| Planning Grant | Implementation Grant |

|---|---|

| Minimum: $25,000 | Minimum: $100,000 |

| Maximum: $75,000 | Maximum: $250,000 |

| Activities: Feasibility study, business development plan, etc. | Activities: Processing costs, marketing, some inventory or salary expenses, etc. |

Match: 10%. Eligible entities: Independent producers, producer groups, producer cooperatives.

How can this be used in meat processing?

Because the VAPG program can only be used by those who produce the raw product, it must be the farmer or rancher who applies. They themselves could become a meat processor, both producing and processing their own meat. Other meat processors who do not raise animals could encourage their customers, i.e. farmers and ranchers, to use the program to develop direct sale markets, bringing new business to the processor in turn.

Applications are typically available in the early months of the year, sometimes beginning in December. To find more information on the program and access to the application visit this USDA Rural Development page.

Local Food Promotion Program

The aim of LFPP is to create or expand local food systems so locally produced raw food can be processed and distributed to local residents. This not only builds a stronger local food economy but provides residents with fresh, high quality food. LFPP grants are available for agricultural businesses, CSAs, local governments, non-profit organizations, producer networks, and other entities.

The application period opens in the spring, typically between March and May. Grants are available for planning and implementation. Planning grants can be used for market analysis, business plans, transportation system development, and other activities taking place before a food system is operational. Implementation grants can be used to implement more efficient transportation systems, create an online wholesale selling platform, update practices and equipment for increased food safety, and other expenditures related to developing, coordinating, or expanding local food businesses.

| Planning Grant | Implementation Grant |

|---|---|

| Minimum: $25,000 | Minimum: $100,000 |

| Maximum: $200,000 | Maximum: $750,000 |

| Activities: Feasibility study, business development plan, technical assistance, etc. | Activities: Food incubators, online software development, transportation, etc. |

Match: 25% or 10%. Eligible entities: Agricultural businesses, CSAs, local governments, non-profits, producer networks, and others.

How can this be used in meat processing?

In some cases, a meat processing business can apply for this funding to expand capacity, sell products at retail locations, organize an online ordering platform, or other activities aimed at expanding access and consumption of local food. In other cases, processors can benefit indirectly by encouraging the development of local food systems around them. This could mean being a partner in an LFPP project to create a way for local farmers and ranchers to sell meat directly to consumers or the establishment of a local food hub, for example.

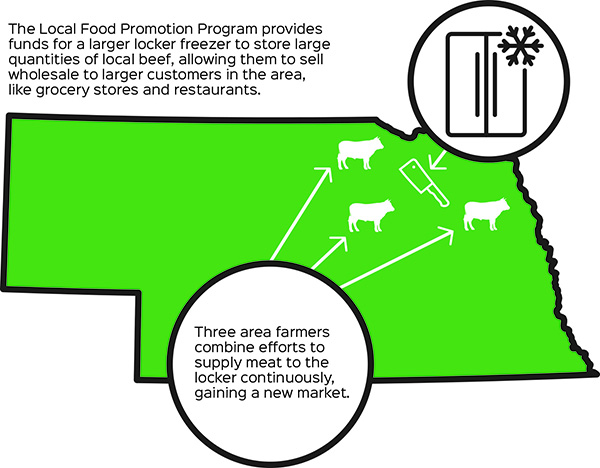

LFPP also requires applicants to have partnerships with other businesses, individuals, or institutions that will mutually benefit from the proposal. While the partners can be loosely connected, they must establish that a structure exists for ensuring local distribution and consumption of the food product. In the example below, the main applicant could be the meat processor, while the three cattle producers are listed as partners who commit to providing the meat and working with the processor. The processor, in turn, uses the grant to develop new local markets.

For more information and to find application materials, visit this USDA web page. You can also contact Agricultural Marketing Service staff members for assistance.

Other federal programs

In addition to the two programs above, there are several federal programs which can also be explored, but do not tie directly to food, agriculture, or meat. For a new or expanding meat processor, these can be excellent programs to offset the cost of a building purchase or repair, utilities, and other components of a small business. We encourage you to consider these and look for other opportunities.

As a further note, many of these programs will not fund a processing business directly. Collaboration with public entities, economic development organizations, and other partners is often necessary to apply.

Rural Business Development Grant (RBDG)

Grants provided through the RBDG program are incredibly versatile. Although businesses themselves are not eligible, local government and private non-profit organizations can support local entrepreneurs in many ways with funding. The funds can be used for most purposes not related to business operating expenses. Examples include demolition of buildings, feasibility studies, or utility expansion. With a maximum grant amount of $500,000, projects of most sizes can be completed.

Business and Industry Guaranteed Loan Program (B&I)

B&I loan guarantees are not meat processing specific but can be used for any rural business. To utilize these guaranteed loans, a private lender, not the business owner, will apply for a guarantee on a loan to a rural business. This may be helpful for individuals with lower credit or difficulty obtaining private loans outright. They cover up to 80% of a loan with a variable, but high, maximum dollar amount.

Rural Energy for America Program (REAP)

REAP can assist businesses in many different ways, primarily with energy production and efficient energy usage. The program provides both loans and grants of different amounts, with grants covering less of the overall project cost. Some eligible expenses are new appliances or lighting, installation of solar panels, or more effective insulation. Most rural businesses are eligible for this program.

Local programs

Many towns have created programs to assist in community economic development. They are generally operated by local governments, regional development agencies, or nonprofit organizations. Their services vary, but small loan and grant programs are often available. Some less direct assistance is also an option. For example, public bodies or non-profits regularly purchase land or buildings for redevelopment or renovation. They can also assist with improvements to sewer, water, broadband, or electricity at reduced rates.

Few, if any, local economic development programs are specifically focused on meat processing. They are aimed at promoting general economic development across industries. Programs offered will differ in each community and region so connecting with professionals in your area is the first step.

Technical assistance and training programs

Meat Processor Academy

The Niche Meat Processor Assistance Network, a community based out of Oregon State University, offers an online, self-paced Meat Processor Academy. The course, designed for meat processors with 25-150 employees, provides intermediate to advanced content on topics related to business, finances, and operational aspects of growing a meat processing business. For more information, visit meatprocessoracademy.com.

Meat and Poultry Processing Capacity Technical Assistance Program

In need of technical assistance? The Meat and Poultry Processing Capacity Technical Assistance Program is accepting inquiries via an online form. Interested processors who fill out the form will be connected with a service provider who can help with topics including federal grant applications, business and financial planning, operational support, and supply chain development. To learn more, visit flowerhill.institute/

Media and publications

Scroll through our blogs and publications below.

Other media

In the news

- June 7, 2022: New grant program aims to help small-town locker plants survive and expand from the Nebraska Examiner

- Feb. 13, 2022: Lawmakers urged to take next step in supporting local meat processors from KNEB/Rural Radio Network

- Jan. 19, 2022: Center welcomes governor’s support for smaller meat processors from WNAX

- Jan. 11, 2022: Legislative bill seeks funding to help local meat processors increase capacity from News Channel Nebraska

Watch

- April 19, 2022: Rural Rapport: Legislative recap

- Jan. 4, 2022: Rural Rapport: Nebraska, Iowa Legislative preview

- July 21, 2021: Webinar: New Opportunities, Future Challenges: A Discussion on Local Food Systems

- June 15, 2021: Rural Rapport: Legislative Recap

- Feb. 16, 2021: Rural Rapport: Small Meat Processing

- Jan. 27, 2021: Webinar: A Meat Sector that Works for Nebraska’s Farmers, Processors, and Customers

- Sept. 10, 2020: Webinar: The Future of Local Meat Markets

Press releases

- Sept. 12, 2022: Independent Processor Assistance Program grants announced

- July 6, 2022: Grant applications now available for Nebraska's Independent Processor Assistance Program

- May 24, 2022: Lawmakers show continued support for Iowa’s small meat processors

- March 22, 2022: Center says funding will create healthy future for rural Nebraska

- Feb. 9, 2022: Lawmakers urged to take next step in supporting local meat processors

- Jan. 13, 2022: Center for Rural Affairs welcomes governor’s support for small meat processors

- Jan. 12, 2022: Bill seeks funding to help small meat processors increase capacity

- Jan. 5, 2022: Nebraska’s new herd share program outlined in guide from Center for Rural Affairs

- Oct. 18, 2021: Butchery program will give meat processors tools they need for growth

- Oct. 24, 2021: With funding, Legislature can continue to support local meat processors

- June 22, 2021: Center for Rural Affairs pleased with USDA’s investment in small meat processors

- May 19, 2021: Lawmakers in Nebraska, Iowa give final approval to bills supporting small meat processors

- April 22, 2021: Legislators, small meat processors, farmers attend press event in support of Iowa bill

- Feb. 3, 2021: Center for Rural Affairs, local processors testify in support of meat processing bill

- Jan. 13, 2021: Bill to assist meat processors, livestock producers introduced

- Dec. 18, 2020: Senators introduce bill that would allow small meat processors to expand

- Dec. 22, 2020: Stimulus funding would help meat, poultry producers expand

- Sept. 29, 2020: New House bill would allow small meat lockers to expand