What's happening with the Center for Rural Affairs? Find the latest on rural America and our work here.

05.12.2023

In Iowa and other Midwest states, agricultural excellence, robust soils, and ample outdoor recreation are points of pride. All of these elements relate to water, and depend upon healthy watersheds.

- Policy

05.11.2023

Meg was hired recently as a local foods associate. She spends most of her time working on the Center’s newest lending initiative: Meat and Poultry Processing Loans.

- Farm and Food

The U.S. Department of Energy (DOE) recently announced a $50 million funding opportunity for Tribal clean energy projects, continuing its efforts to promote clean energy development in Native American...

- Policy

05.10.2023

Students and faculty at Central City High School, along with Central City FFA, in Central City, Nebraska, have spent the past few years building their greenhouse program to the point where they’re now able to provide their cafeteria with fresh vegetables throughout the school year.

- Small Towns

- Farm and Food

05.09.2023

On May 4, the 2023 Iowa legislative session came to a close. In the last days of the session, lawmakers passed a series of budget bills and final priorities, including items we believe will have positive rural impacts.

- Policy

05.08.2023

The Center envisions a vibrant future with strong rural communities and robust local economies. We work hard to ensure that everyone who calls rural America home will have the opportunity to fully...

- Small Towns

05.03.2023

Last week, Legislative Bill (LB) 84, which would keep the gross income eligibility requirement for the Supplemental Nutrition Assistance Program (SNAP) at 165% or below of the federal poverty level, rather than reverting back to 130%, was unanimously voted out of the Health and Human Services (HHS) Committee. The bill was then added as an amendment to the committee’s priority bill, LB 227, which was advanced to final reading.

- Policy

05.02.2023

A través del ejemplo de su madre, Cesia Madrigal Góngora y otros miembros de la familia están aprendiendo a luchar por sus sueños.

- Lending

- Small Towns

05.02.2023

Through her mother’s example, Cesia Madrigal Góngora and other family members are learning to fight for their dreams.

- Lending

- Small Towns

05.02.2023

We are in the 17th week of the Iowa state session, and the end appears to be in sight. This week, lawmakers are working to wrap up final business—including passing the state budget for the upcoming fiscal year.

- Policy

05.01.2023

El desarrollo de pequeños negocios en el Centro inicio en 1990 y ha evolucionado con la adición del Centro de Negocios de Mujeres en 2001, luego un enfoque añadido hacia los negocios pequeños de los latinos.

- Lending

- Small Towns

05.01.2023

Small business development at the Center started in 1990 and has evolved with the addition of a Women’s Business Center in 2001, then an added focus on Latino small businesses.

- Lending

- Small Towns

04.28.2023

Angelyn Wang has lived in Omaha for the past six years and has gained insights into the importance of the role of rural people and communities.

- Farm and Food

04.25.2023

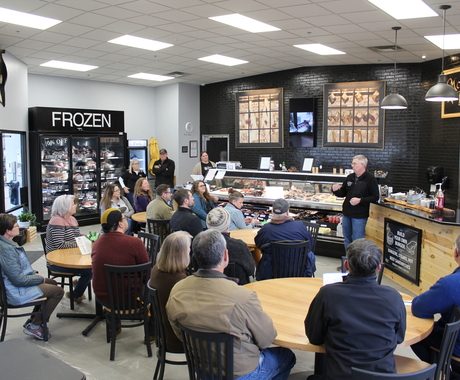

McLean Farms is in it's fourth generation of a cattle family and they have grown their business into a meat processing business with the addition of a store and restaurant.

- Farm and Food

04.24.2023

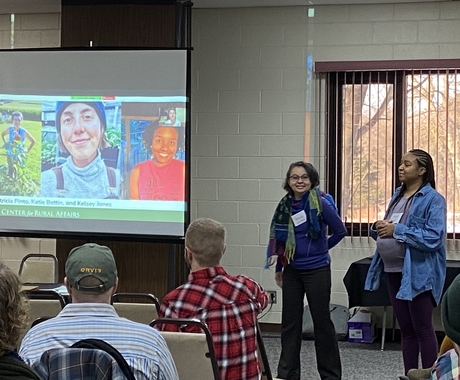

The Center for Rural Affairs’ farm and community-focused work was highlighted at this year’s Nebraska Sustainable Agriculture Society (NSAS) Conference in Aurora, Nebraska.

- Farm and Food

04.20.2023

Organic farmers want more time to get their corn crops in the ground and still be able to qualify for crop insurance. Right now, they are held to the same timelines as conventional farmers, which they say puts them at a disadvantage and could cost them their full insurance coverage.

- Farm and Food

- Policy

04.19.2023

We are in the 15th week of the Iowa state legislative session, and expect things to wrap up in the coming weeks. April 28 will be the 110th calendar day, when lawmakers’ per diem expenses end, though is it not unprecedented for the session to run beyond that date.

- Small Towns

- Farm and Food

- Policy

04.19.2023

Jim and Lisa French from Partridge, Kansas have dedicated their lives to community, healthy water, soil health, and conservation.

- Small Towns

- Farm and Food

- Policy

04.18.2023

Last week was an eventful one in the Nebraska Legislature. Debate on two controversial bills led to continued filibustering. With only 26 days remaining in the session, the Legislature is adopting a “Christmas tree” method of passing legislation this year, with parts of, or entire bills, being added as amendments to committee priority bills.

- Small Towns

- Farm and Food

- Policy

04.17.2023

Passed approximately every five years by Congress, the farm bill is a package of legislation covering many topics that affect rural communities. From conservation programs for farmers to healthy food...

- Farm and Food

- Policy